Happy holidays to everyone and a warm welcome to 2018!

2017 was quite the rollercoaster. It started with Donald Trump's inauguration, accelerated with seemingly one hurricane after another, and reached a crescendo with the Crypto craze of the fall and winter. It was also an up and down year for the tech startup ecosystem. For every success story it seemed there was a controversy. For every Nintendo Switch, there was an Uber. For every Oscar Health, there was #FakeNews. It was also a landmark year on a personal note as I got married in October!

What does 2018 have in store for us? Here are my three trends in tech to watch in the new year.

The Rise of New Tech Hubs

2017 was the year that tech started to notice the rest of the world. 2018 will be the year that the rest of the world changes tech forever.

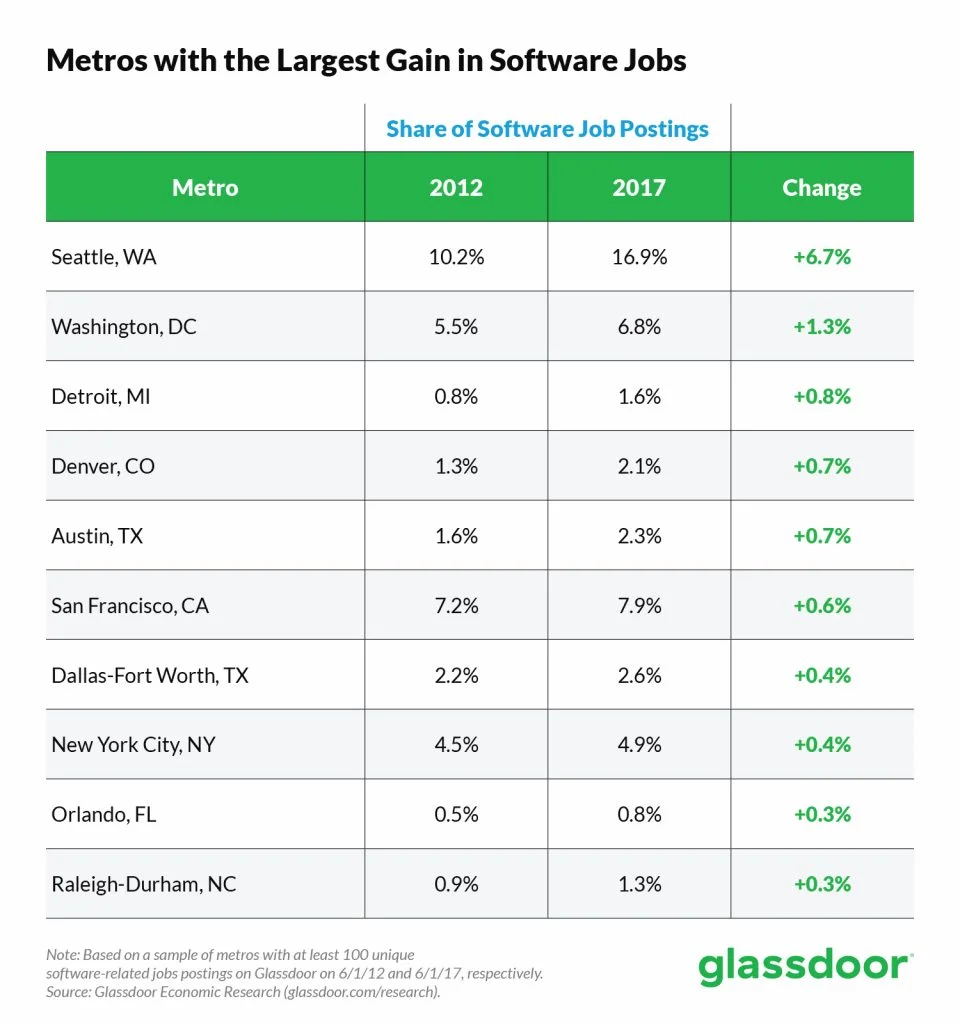

In 2017, we saw investors and entrepreneurs begin to look outside of the coasts for companies and innovation. Pittsburgh-based Duolingo raised capital at a $700 million valuation and recently crossed the 200 million user threshold. Revolution's Rise of the Rest fund raised $150 million (with LPs including the likes of Eric Schmidt, Jeff Bezos, Henry Kravis, and Meg Whitman) to invest in startups across the Midwest. Duo Security became Ann Arbor's first unicorn. The below table on the geographic spread of tech jobs in America, from a report by job rating site Glassdoor, clearly shows the growth that "non-traditional tech hubs" are having.

I believe that this trend will only accelerate in 2018. New tech hubs like Columbus and Raleigh are churning out exciting company after exciting company, and more investors will surely join the likes of Revolution and Drive Capital by taking notice.

The Legitimacy of Zebras

2017 was the year that we began questioning the Unicorn worship that is pervasive in tech today. 2018 will be the year that we accept that Zebras are every bit as legitimate, and important, as their horned cousins.

For anyone not familiar with the term, a "Zebra" is a company that is focused on sustainable growth and producing profits. It sheds the "growth at all costs" mentality that is widespread in tech and focuses on working with, instead of against, their fellow companies. The reality is that in the tech space, we are exposed to some pretty severe survivorship bias. The companies that get all of the attention in the media are the Ubers/Facebooks/Googles of the world. And that is totally justified! These companies took off like rocket ships and totally changed each of their respective spheres of influence. But these companies only represent about 1% of the venture-backed startups out there. An ecosystem that views outcomes like this as the only version of success is not only unsustainable, but it misses the big picture. There are plenty of exciting, innovative, game changing, companies that will never unlock the level of growth that an Amazon was able to achieve. And that is ok. It is very difficult, if not impossible, for companies in vital sectors like deeptech or biopharma to achieve the astronomical growth that a software company can achieve simply because those technologies cannot scale like software can.

Zebras are the innovation workhorses of our economy. They may not drive venture returns, but they employ millions of people across the country and account for a huge amount of growth in the tech sector. I believe that we will see more venture funds focus on this large swath of startups in 2018. The key will be whether or not firms are willing to adjust their fund structures to accommodate more winners at lower multiples, which leads me to...

Structures That Add Value

2017 was the year that every VC realized the importance of adding tangible value to their portfolio companies. 2018 will be the year that the structure of venture funds starts supporting this critical mission.

I believe that traditional VC fund structures are not actually ideal for investing in startups. The current 2+20 fee structure (2% management fees and 20% carry over a preferred hurdle) and 10 year fund lifespan are simply holdovers from private equity that have been shoehorned into venture capital because that is what both GPs and LPs are most comfortable with. These "golden rules" for fund structure are followed almost universally across the industry, but can often be overly rigid for the ups and downs of growing a startup. What if there is a better way? It is only in the last couple of years that a select few firms have even begun to wrestle with this question.

Some firms like indie.vc are adjusting their fund structure to accommodate a different profile of startups. Instead of purchasing equity upfront, indie.vc receives equity options that only execute when companies either achieve an exit or raise a preferred equity round and is entitled to profit sharing up to a maximum of 3x on the cost of the initial investment. This allows the VC and the company to have aligned incentives, even if the company chooses to forgo the traditional focus on raising equity rounds at ever higher valuations and focus on producing profits.

Other firms are redefining the roles of traditional stakeholders in fund structures. Village Global leverages its LP base as mentors and advisors to its portfolio companies, giving LPs a powerful and compelling stake in driving their own value and unlocking a previously untapped resource for founders. Kindred and the Upside Partnership incentivize cross-portfolio collaboration by making every founder they invest in a backer of the fund itself. Suddenly seemingly disconnected portfolio companies can leverage their individual expertise to drive value and innovation across the whole portfolio.

VC firms are finally starting to show some of the same innovation that they have always looked for in investments. 2018 will be the year that the very structure of funds will become a key differentiator in the space.

Thanks so much for reading. If you enjoy posts like this, feel free to subscribe at the top of this page. Be sure to leave a comment below if you have any suggestions or topics that you would like to see covered.