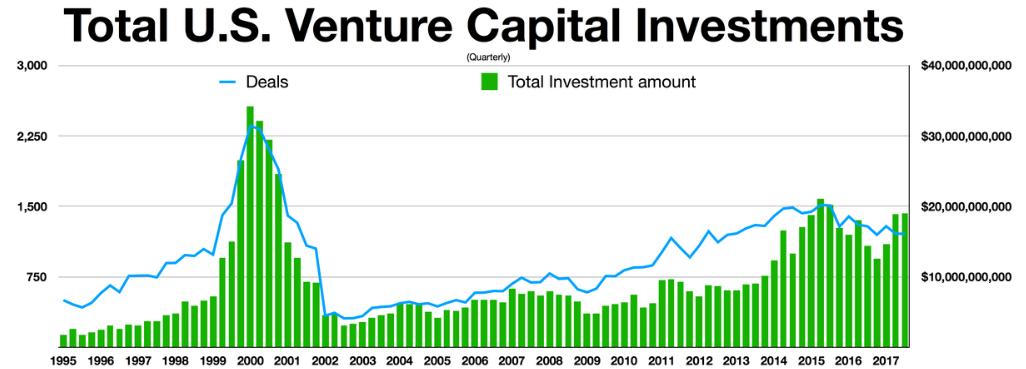

Figure 1. Via NVCA. As of Q2 2018.

Anyone familiar with the venture capital industry will know that we are in an investing and fundraising environment that is relatively unprecedented in the history of venture capital. The rise of “mega-funds” totaling sizes of up to $100 billion in the case of Softbank’s Vision Fund, has lead to deals at sizes that have never been seen before. Uber’s most recent $500m round lead by Toyota valued the company at over $70 billion dollars. The high-dollar amounts and the relatively frothy fundraising environment have instigated headlines ranging in size and shape but almost universally pessimistic as to the outlook of the industry. Some people believe that we are in a bubble the likes of which has not been seen since 2000. Others, especially LPs, Corporate VCs, and Growth Equity shops believe it is an excellent time to get increased exposure to the space. I did some digging into the data to try to find out exactly what is going on.

Here’s what I found.

We are a long way away from seeing Dot-com crash levels

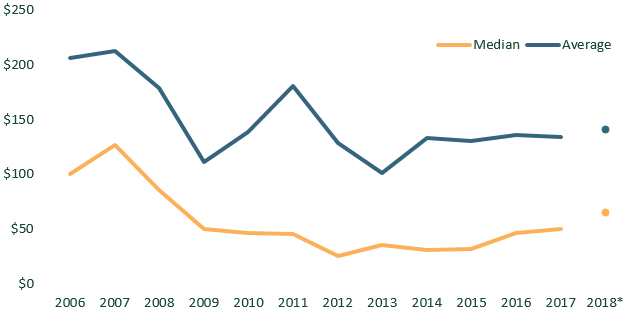

Figure 2. Via NVCA

Some have compared the current venture climate to the Dot-com bubble of the early 2000s where companies could go public and double their value just by adding “.com” to the end of their name. Everything quickly came tumbling down and investors discovered that simply putting something on the internet was not a way to create lasting value. Despite high-valuation numbers, the current environment remains a far cry from the Dot-com bubble. As Figure 2 illustrates, the current climate is the outcome of an elongated period of sustained industry growth and demonstrates neither the hyper-acceleration of deals we saw in 1999 nor the crash’s sizable peak investment amount. If we are in a bubble, it will look very different when it bursts.

Fund sizes are not as big as you think they are

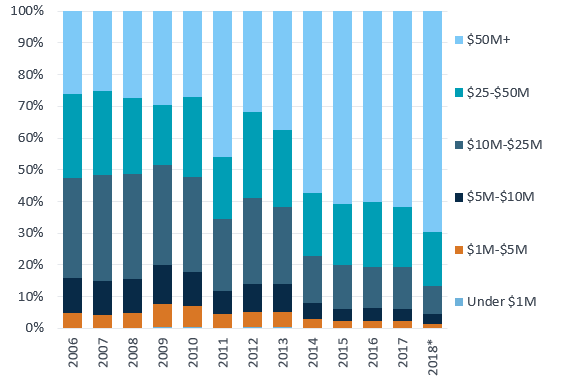

Figure 3. Via NVCA. As of Q2 2018.

This one surprised me and definitely flies in the face of the popular narrative. When looking at the industry as a whole, fund sizes are not meaningfully larger than they were a decade ago. What is important to notice though is how the spread between the average fund size and median fund size has expanded. This indicates that the absolute largest funds at the top of the spectrum are dragging the average fund size up as the median fund size has risen much more modestly.

But median follow-on fund size is increasing…

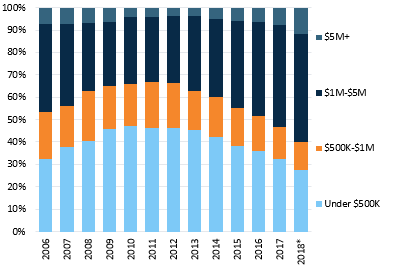

Figure 4. Via NVCA. As of Q2 2018.

…even as the time between funds shrinks

Figure 5. Via NVCA. As of Q2 2018.

These trends definitely show the frothy fundraising environment that firms are enjoying. Venture firms have been able to raise larger follow-on funds more and more often. This phenomenon is not unique to venture capital. I saw first hand at my prior job just how much of a desire there was from institutional investors to gain exposure to alternative asset classes. It will be interesting to see if these trends are sustainable as deals take an increasingly long time to exit.

Deals are take an increasingly long time to exit

Figure 6. Via NVCA. As of Q2 2018.

Told you so. The time to exit for venture backed companies has slowly crept upwards over the past decade. The exception to this is companies exiting through a public offering where time to IPO has stayed largely flat and is even slightly down versus a peak in 2012. This speed to IPO makes sense in light of the many venture backed companies that have had their shares publicly listed over the past couple of years including StitchFix, Snap, and Shopify (those are just the high profile ones starting with S! Seriously though do you think there is something there…? I’ve decided that I am going to name my future company Soogle.)

Corporate Venture Capital is getting in on the fun

Figure 7. Via NVCA. As of Q2 2018.

One of the hot takes on the current environment I have heard a couple of times now is that “the growth of corporate venture programs is a clear sign that we are in a bubble.” This seems pretty difficult to say with any measure of confidence due to the fact that we have been through a grand total of ONE venture capital bubble before, but it is hard to ignore the growing leverage over the space that CVCs are enjoying. I found it very interesting that the percent of deals that have involved corporate venture arms has stayed relatively flat, even as the overall percentage of deal value has increased by approximately 50%. Corporates are putting significantly more capital to work as they take more ownership in bigger rounds.

Deals are bigger than they used to be

Figure 8. Via NVCA. As of Q2 2018.

Speaking of bigger rounds. This chart of median deal size does a great job of illustrating the growth of later stage rounds compared to early rounds. As you can see, the driver behind the growth in deal size really is later stage rounds. This makes sense. There has been an explosion of both corporate VCs and Growth Equity shops to go along with larger mega funds. All of these groups have large funds that need to deploy large amounts of capital at once.

Even within Late stage, deal sizes are being driven by the top of the curve

Figure 9. Via NVCA. As of Q2 2018.

This one is very interesting. This chart shows dollars invested into late stage rounds by deal size and does a great job of demonstrating that even in the later stages, the biggest deals are taking up a larger and larger portion of the pie.

Valuations are getting more and more expensive

Figure 10. Via NVCA. As of Q2 2018.

Figure 10 shows the increasing pre-money valuations that we are seeing today. What is causing this growth in valuation? The relationship between deal size and valuation can be a little bit like the chicken and the egg. Are deals bigger because valuations are higher and firms need to deploy more capital to maintain their targeted ownership? Or are valuations higher because there is a glut of capital and entrepreneurs are getting more capital for less ownership in their company? Given the similar trends in private equity, I tend to believe it is more of the latter. I believe low interest rates have caused large institutional LPs to allocate more capital towards alternative assets in search of yield. Suddenly managers had significantly higher fund sizes and needed to allocate more dollars to each deal. Entrepreneurs (and investors!) don’t want to be over-diluted and this has pushed up valuations as they are able to command higher valuations for the higher deal sizes.

Seed deal size are increasing (even if relatively less than later stage)

Figure 11. Via NVCA. As of Q2 2018.

Seed deals are showing a clear trend of getting bigger too. More deals are being done with larger round sizes. Hunter Walk has a great post about how seed is no longer a discrete round, but now more of a phase where companies may need to raise multiple rounds at higher and higher valuations before being ready for an institutional Series A. I suspect this is one of the big drivers for increasing seed sizes (on top of the macro-trends growing round sizes across the industry).

Angels are surprisingly disciplined (or more likely they are being shut out of deals)

Figure 12. Via NVCA. As of Q2 2018.

Angel investors are not following the same trends as institutional investors. Figure 12 shows the growing discrepancy between angel and seed median round size. There are a few potential explanations of this. 1) Angels are maintaining price discipline (maybe out of necessity?) where others are not. 2) Friends and family rounds are not growing the same way other rounds are since they are not exposed to the same institutional LPs as funds are (could be). 3) Angels are being squeezed out of more expensive seed deals. My hunch is that it is likely a mix of all of the above, but if I had to put the blame on one thing, it would be angels getting squeezed out of rounds. For better or for worse, Entrepreneurs would generally prefer institutional investors to angel investors, with the abundance of capital being thrown around today, my guess is that angels aren’t getting into deals because there is simply enough interest from institutional investors to close out rounds. This one is very interesting to me because we are still seeing heavy involvement from angel investors in the deals we are executing at Rev1. Maybe we chalk this one up to the coasts?

So what did we learn from my deep dive? Digging into the statistics showed some of what we already knew, but it also revealed some insights I wasn’t expecting. The largest funds are getting bigger, deals are getting bigger, and valuations are getting bigger. Venture Capital firms are raising larger follow on funds at a more rapid clip than ever before. There are; however, some things we found that fly in the face of the popular narrative. Angel investors are not being effected (perhaps unsurprisingly) by some of the same trends effecting the industry at large, fund sizes are not meaningfully larger when you look at the industry as a whole, and the current environment has not yet reached the heights of the Dot-com bubble.

It is dangerous to rely too heavily on historical events as a sign of things to come. As with most things, the truth is somewhere in the middle.