I hope you all had a pleasant holiday season and a happy new year! My wife and I went back to The Commonwealth to spend some wonderful R&R with friends and family. It was quite the “break” with a lot of family time, my first ever successful cooking of traditional Norwegian Juleribbe, my first ever debutante ball, and a New Year’s Eve filled with board games and Super Smash Bros until the wee hours of the morning.

My family is big on traditions, especially around the holidays. We eat the same foods for Christmas and every New Year’s Day growing up we would go to Buffalo Wild Wings (kinda random I know) and make our New Year’s resolutions while watching the bowl games and eating chicken wings. Last year I started a tradition here of making some predictions about the year to come and I thought it would be fun to evaluate how they did before making a few new predictions for 2019.

2018 Predictions

The Rise of New Tech Hubs

Last year, I predicted we would see new tech hubs really solidify themselves as leaders in the space. Of all my predictions I think this one has turned out to be the most true. New hubs for technology have been flourishing for years, but 2018 was really the year that people began to sit up and take notice. The tech scenes in places like Columbus, Nashville, Ann Arbor, and Denver have a new found legitimacy that is demanding coastal investors take notice. This has also come at a time when the largest tech giants are under increasing amounts of scrutiny and the socio-economic situation in the Bay Area has grown more tenuous than ever. I had so much confidence in this trend, that I bet my career on it, and I have had the pleasure of getting to experience the best of what a growing tech ecosystem has to offer first-hand. It has been an absolute thrill to be a part of and I am confident this trend will continue to accelerate into 2019!

The Legitimacy of Zebras

For 2018 I believed that the VC world would wake up a little bit and take notice of more sustainable business models than the boom or bust unicorn hunting that the sector has become known for. Unfortunately it seems to me that, at least in SV, the opposite is true. As record amounts of capital were pumped into the space by ever-growing mega funds, the swing-for-the-fences mentality only seemed to heighten. I understand that VC is a power-law sector where the majority of returns are made only by the top firms/companies, but I worry that in the pursuit of growth at all costs the sector has let valuations get away from them and overlooked wide swaths of new businesses that can be built on more sustainable, cash-flow focused models.

Structures that add value

In 2017, we were starting to see what I thought was the beginning of a trend of innovation within venture capital fund structures. I thought this trend would continue into 2018 and we would see some true innovation in value-add fund structures. This turned out to not really be the case. The same crop of firms that were doing new and interesting things, like indie.vc and Kindred, continue to test their models, while structures for the rest of the industry have remained largely intact. Credit where credit is due, Indie.vc did roll out a new v3 model which is very interesting and seems to have had some initial success, but that announcement happened on January 1, 2019 so I don’t think I can really count that in my favor in good conscience! I think the lesson here for me is that any innovation in fund structure will have a LONG lead time towards wider adoption. Fund feedback loops are simply too long and the outcomes too opaque for other firms to take the career-risk involved with adopting an innovative model.

2019 Predictions

Mega Funds take a Mega Hit

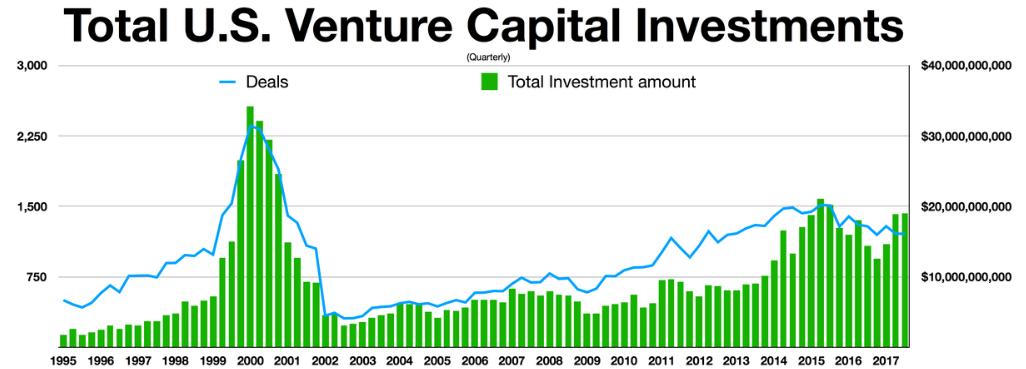

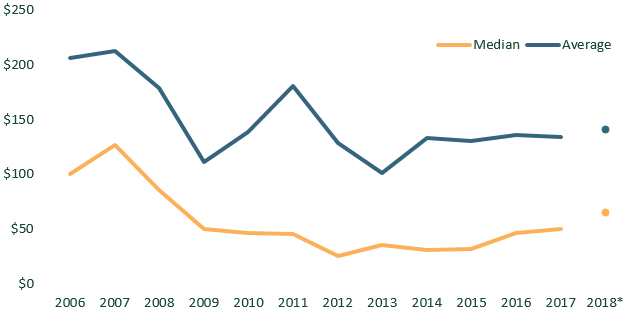

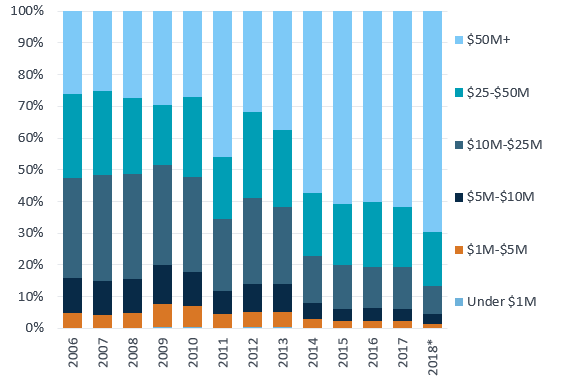

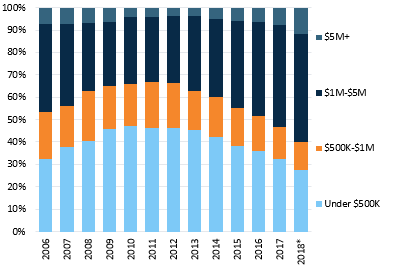

The dominant story in VC over the past year has been the rise of mega-fundraises for both companies and firms. SoftBank’s $100 billion Vision Fund was the spark that started off this explosion, but other big players in the space were quick to follow suit by raising ever larger funds of their own. This trend was also fueled by the combination of a very strong bull market (except for Q4) and an environment of still relatively low-interest rates where major LPs were starved for returns and turned towards alternative assets. I think the writing is on the wall that both of those exogenous factors will be disrupted in 2019 with rising interest rates and growing global economic uncertainty. Within tech, I think we will see a good portion of companies that have raised “mega-rounds” really struggle. There are some companies, like Uber, that have a strong, but costly, business model that can bear to raise hundreds of millions of dollars. However, I do not believe the majority of companies raising these mega rounds fall into that category. They will face the same struggles that all overcapitalized startups face, a lack of fiscal discipline and an inability to meet unrealistic expectations. I predict that the combination of both this financial environment change and the underperformance of many of these companies will lead to a significant pull back in terms of firm fundraises as well as smaller company funding rounds from the all-time peaks of 2018.

Crypto starts showing signs of life

The second biggest story of 2018 was that Crypto got absolutely clobbered. Like I am talking demolished. Basically crypto took the hit that got Jadeveon Clowney drafted first overall (and which still causes him to be incredibly overrated despite being a mediocre pro-football player). The price of Bitcoin (a pretty good barometer of the space in general) started at $13,850 on January 1, 2018. On January 1, 2019 it had fallen to $3,747. A rough year to say the least… I think the majority of us in tech saw a correction coming in 2018 after the irrational exuberance of 2017, but few that I know of predicted it would be quite so dire. Overall, I think this will be a very good thing for the ecosystem. The story of 2017 and 2018 was easy come, easy go. I predict that the story of 2019 be that the cream rises to the top. It was too easy to raise money in 2017/2018 and greedy/lazy/bad actors flowed into the space until the bubble popped. Now that some of the sheen has worn off, I think the smart, passionate true believers will be able to hunker down and get to work without the distraction of the mania. I predict that 2019 will still have its ups and downs, but that we will see the overall health of the ecosystem steadily start to re-accelerate. As an indicator of this, I believe that Bitcoin will end 2019 above $8,000 (complete thumb in the air prediction here).

Tech liquidity gets weird

Liquidity has always been an issue in tech, but the trend of mega funds/rounds has only exacerbated this as companies have chosen to stay private for longer. There is an absolutely stacked lineup of potential IPOs this year including the likes of Uber, Lyft, Palantir, and Slack, just to name a few. This liquidity will be great for investors and founders and will pump capital back into the ecosystem as early employees start angel investing into nascent startups. Unfortunately, I predict that due to global economic headwinds and rising negative sentiment towards tech companies the majority of these newly public companies will underperform in the public markets for the year. The silver lining to all of this is that I believe efforts will continue to find new and interesting paths to liquidity for investors and entrepreneurs including smart secondaries and things like the Long Term Stock Exchange.

Startup I am most excited about: Lambda School

I thought it would also be fun to highlight the startup (excluding any that I have any sort of business relationship with) that I am most excited to watch in 2019. That company is definitely Lambda School! Lambda School was founded by Austen Allred and is a 30-week coding bootcamp that is absolutely free to start. Lambda makes its money with Revenue Sharing Agreements as students graduate and get new jobs. I have written about structures like this before and I absolutely love the incentive alignment that they provide! The more you get paid as a graduate, the more that Lambda makes in revenue for teaching you. I have been on the lookout for new innovative companies like Lambda in the edtech space and I think they fulfill a very interesting niche by equipping people for the future of work in a low upfront cost, incentive aligned manner.